The Ultimate Jumpstart for Your Family’s Financial Journey

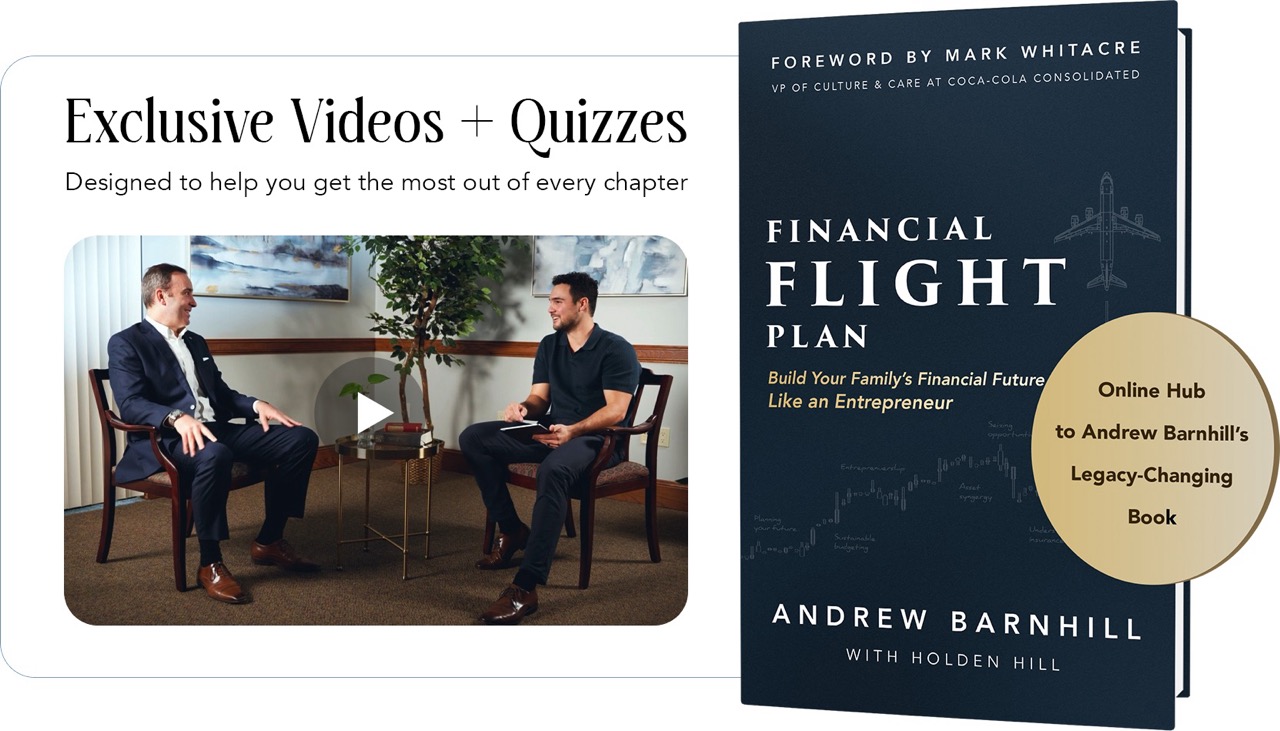

Featuring 7 exclusive video conversations with the author, plus reflection quizzes for each chapter to help you create actionable clarity and accelerate your financial growth.

The content of this website and the book “Financial Flight Plan” is for Educational purposes only and should never be construed as investment, tax or legal advice.

1.

Access the free Online Hub

2.

Follow the steps to accelerate your family’s financial journey

3.

Enjoy the growth (and confidence) that comes with strategic decisions

1.

Access the free Online Hub

2.

Follow the steps to accelerate your family’s financial journey

3.

Enjoy the growth (and confidence) that comes with strategic decisions

What's Included?

Video Debriefs + Takeaway Quizzes

for Each Chapter of Financial Flight Plan

Chapter 1: Flameout

Taking Ownership of Your Plan

Breaking free from one-income dependency, sharpening your personal vision, and identifying what true financial control looks like for your family.

Chapter 2: Flight School

Unlocking Your Next Income Engine

Exploring how to balance financial offense and defense, build assets that work for you, and apply simple strategies to generate additional income streams.

Chapter 3: Takeoff

Laying the Foundation for a Unified Financial Vision

Getting your family on the same page, building trust through clear communication, and creating a strong financial base that aligns with your values.

Chapter 4: Cruise

Creating Synergy Across Your Assets

Moving beyond individual investments to build a connected strategy, knowing when to delegate, and assembling a team that accelerates your independence.

Chapter 5: Turbulence

Protecting What Matters Most

Preparing before the storm hits by building strong defenses, understanding legacy policies, and setting up protection strategies that create peace of mind.

Chapter 6: Arrival

Aligning Wealth With Purpose

Shifting from accumulation to intentional impact, planning your next season with clarity, and reimagining how generosity and strategy work together.

Chapter 7: Horizon

Transferring Vision and Values Across Generations

Bringing the next generation into the conversation early, modeling trust over control, and passing down principles that outlast wealth itself.

About Andrew Barnhill

Andrew Barnhill has helped dozens of families achieve financial freedom. As a commercial pilot-turned-wealth building advisor, he emphasizes entrepreneurial strategies that build passive income and leave a legacy for future generations.

Andrew has started 6 companies, owns 7 residential real estate properties and 2 commercial properties, actively manages an extensive stock options portfolio, and contributes his family’s Legacy Insurance Policy which will become self-compounding by age 55.

Andrew lives in central Texas with his wife Stephanie and enjoys fishing with his two young boys.

Check the background of this investment professional on FINRA’s BrokerCheck: www.brokercheck.org

Check the background of this investment professional on FINRA’s BrokerCheck: www.brokercheck.org

Securities and investment advisory services offered through Hornor, Townsend & Kent, LLC (HTK), Registered Investment Adviser, Member FINRA/SIPC. 800-873-7637, www.htk.com. Any other listed entities are unaffiliated with Hornor, Townsend & Kent, LLC. The views expressed are those of the presenting party and may not necessarily represent those of HTK or its affiliates. The material is not intended to be a recommendation, offer or solicitation. HTK does not provide legal and tax advice. Always consult a qualified tax advisor regarding your personal situation and a qualified legal professional for your personal estate.

We are insurance and securities licensed in our resident state of TX, as well as other states. Please contact us for additional listing of licensed states. This is not an offer or solicitation in any state where not properly licensed or registered. 8733819RG_Feb28